Bitcoin: The Truth Behind the Best Asset Class

💸 Is Your Money Losing Value?

The Problem with Money Today

For most people, money is a given. It’s what we trade for goods and services, and we don’t think too much about it beyond that. But what if we told you that money, as it exists today, is inherently broken?

Long-Term Thinking: If you zoom out and look at the history of fiat money, it’s clear that the current system—where central banks control the supply—has led to decades of inflation and devaluation of savings. What happens over time? It erodes your wealth.

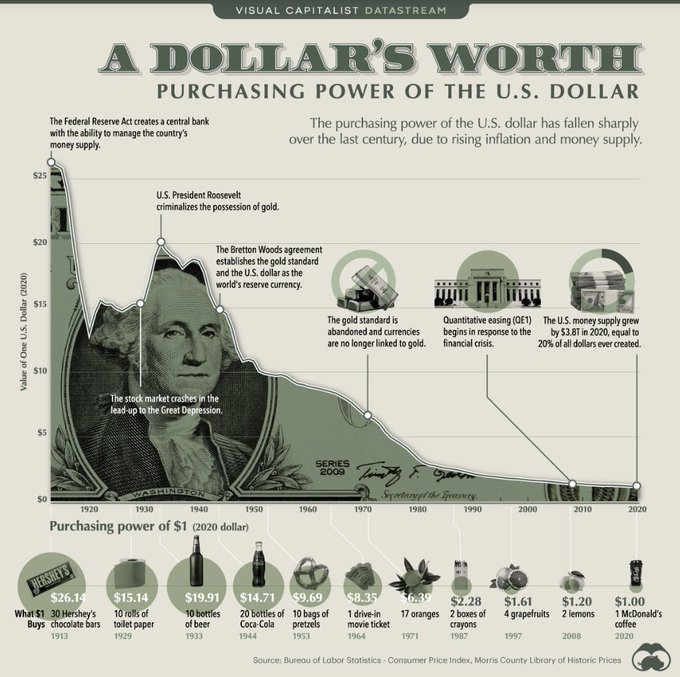

USD Purchasing Power (1913–Today)

Chart: The dollar losing over 96% of its value since 1913.

📉 Inflation: The Hidden Tax

When a government can print an unlimited amount of money, the value of each dollar diminishes. Over time, this is a guaranteed wealth transfer from the average person to those who control the printing press.

Long-Term Thinking: Look at inflation not just as a yearly trend, but as a decades-long process. What happens when you hold your savings in an asset like fiat money that loses value over time? You lose wealth slowly but surely, especially as prices of everyday goods continue to climb.

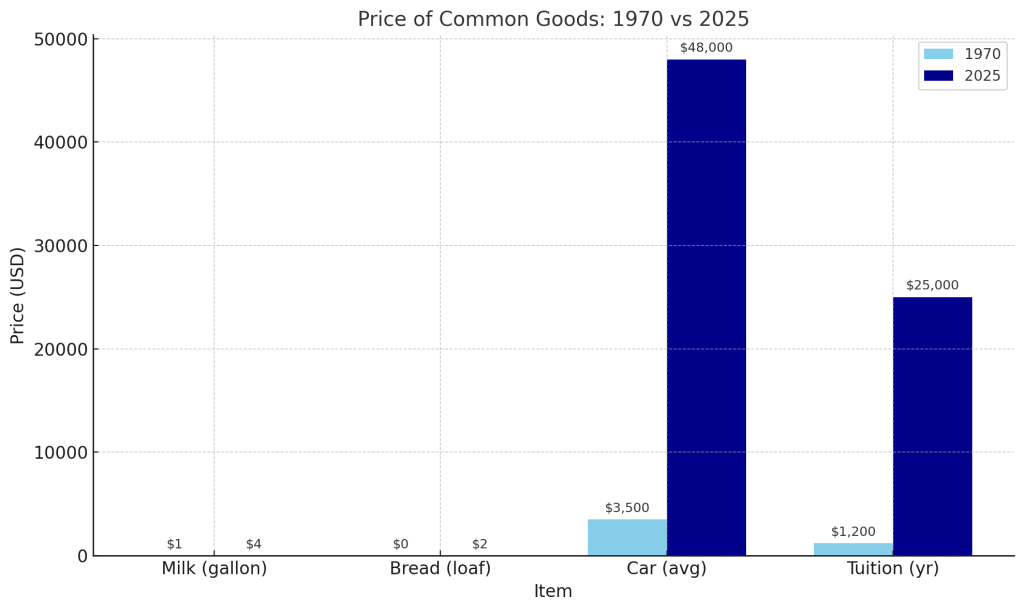

Chart: Price of Common Goods (1970 vs 2025)

Table: Price Comparison of Staple Goods (1970 vs 2025)

This table illustrates how the prices of common everyday items have risen dramatically over the past five decades.

| Item | 1970 Price | 2025 Price |

|---|---|---|

| Milk (gallon) | $1.15 | $4.38 |

| Bread (loaf) | $0.25 | $2.35 |

| Eggs (dozen) | $0.60 | $3.20 |

| Car (average) | $3,500 | $48,000 |

| Tuition (year) | $1,200 | $25,000 |

| House (average) | $23,500 | $390,000 |

| Gas (gallon) | $0.36 | $3.85 |

| Postage Stamp | $0.06 | $0.68 |

Table comparing the price of common goods 1970 vs 2025 and how they skyrocketed

Summary:

The significant increase in prices isn’t necessarily because goods have become more valuable—it’s because the U.S. dollar has lost purchasing power over time. This process, known as monetary debasement, happens when more dollars are printed into existence, diluting the value of existing money. As a result, it takes more dollars to buy the same goods.

👉 This is why understanding sound money is critical—and why Bitcoin, with its fixed supply of 21 million, offers a fundamentally different approach to preserving long-term value.

The question is, how long can you afford to keep your wealth in a currency that is guaranteed to lose value? The answer for most people is, not much longer.

🧠 The Cantillon Effect: Who Wins in This System?

With fiat money, those closest to the money spigot (banks, large corporations, governments) get to spend first. By the time that money reaches the average person, prices have already risen.

Long-Term Thinking: The winners in this system are the ones who have access to capital early, and the losers are those who save and work hard. Over decades, this deepens wealth inequality. Inflation punishes savers and rewards those who already hold assets—leading to an increasingly imbalanced system.

🔒 Enter Bitcoin: Scarce, Sound Money

Bitcoin is a fixed-supply digital asset—there will never be more than 21 million BTC. It’s decentralized and runs on a global, open-source protocol. Unlike fiat currencies, Bitcoin can’t be manipulated or inflated.

Long-Term Thinking: This is where the real opportunity lies. Bitcoin was designed with the long term in mind. Its protocol, inflation schedule (every 4 years, Bitcoin’s reward halves), and the gradual reduction in supply all point toward long-term scarcity and value retention. It’s the opposite of fiat money, which can be printed at will.

Bitcoin offers a way out of the constant devaluation of savings, a hedge that grows in value over time because of its scarcity and decentralized nature.

📈 Long-Term Performance: Why Bitcoin is Unmatched

Here’s where Bitcoin truly shines: long-term performance. When you compare Bitcoin to traditional assets, it becomes clear: if you hold it long enough, Bitcoin has outperformed virtually every other asset class in history.

Long-Term Thinking: You don’t have to worry about trying to time Bitcoin’s daily or monthly swings. If you buy and hold for several years, Bitcoin has historically shown massive returns. Even during crashes or bear markets, the long-term trend has been upward.

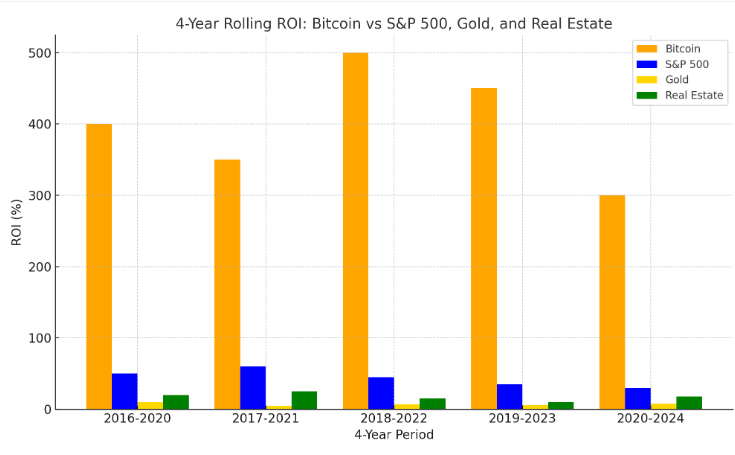

Chart: 4-Year Bitcoin ROI vs S&P 500, Gold, Real Estate

A bar graph comparing the performance of Bitcoin to traditional assets over rolling 4-year periods.

No matter when you entered the market in Bitcoin’s history, if you held for 4+ years, you came out ahead. Compare that to stocks, real estate, or bonds, which are much slower and more volatile in the long run.

Historical Perspective

If you look at rolling timeframes, Bitcoin has always outperformed all major asset classes when held for a sufficient duration. Here’s how it typically plays out:

⏱️ 4+ Years (One Halving Cycle)

- This is the critical threshold.

- Historically, every 4-year holding period since Bitcoin’s inception has resulted in positive returns, no matter when you bought.

- This aligns with Bitcoin’s halving cycle, which tends to drive long-term bull runs.

✅ Best timeframe to measure BTC performance: 4+ years

📈 Historical ROI: 100%+ in all past 4-year spansReal-World Example:

- Bought the top in 2017? Around $19,000.

- Held until end of 2021? Price hit ~$47,000.

- That’s a ~+250% return, despite gut-wrenching dips along the way.

🆚 Compared to Traditional Assets (Over 4+ Years):

Asset Typical 4-Year Return Risk Profile Inflation Hedge Censorship Resistant Bitcoin 200–1000%+ High ✅ Yes ✅ Yes S&P 500 ~60–80% Medium ❌ No ❌ No Gold ~10–20% Low ✅ Partial ❌ No Bonds ~5–15% Low ❌ No ❌ No Real Estate ~20–40% Medium ✅ Partial ❌ No

⏱️ 5–6+ Years

- At this range, BTC crushes everything else—stocks, gold, real estate, you name it.

- The compounding effect of Bitcoin’s explosive growth starts to dwarf the returns of traditional assets.

🔁 Example:

Even if you had bought the top of the 2017 bull market ($19,000) and held until the end of 2021:

- You’d be up ~250%+.

- Compare that to the S&P 500’s average 5-year return of ~60–70%.

💸 Returns

- Bitcoin has outperformed virtually all major asset classes over the past decade (since 2010), with annualized returns far above stocks, real estate, gold, etc.

- But it’s also had multiple 80%+ drawdowns, so the volatility is extreme. That’s why holding long-term (4+ years) is so important.

The Takeaway

Time in the market > Timing the market.

Bitcoin is volatile in the short term but unbeatable long-term—if you’re patient.

If you’re looking for a hedge against fiat debasement, long-term value preservation, and an asymmetric bet on the future of money, Bitcoin stands alone.

The Longer You Hold, The Stronger Bitcoin Gets

A good holding period for Bitcoin is 4+ years.

A better holding period is 10 years.

The ideal holding period? Forever.

❌ Common Myths (Debunked)

- “It’s too volatile” → Yes, Bitcoin is volatile—but it’s this very volatility that creates the asymmetric opportunity for long-term holders.

- “It’s bad for the environment” → Bitcoin uses more renewable energy than any other major industry, and its infrastructure is still evolving to be more efficient over time.

- “I’m too late” → You haven’t missed the boat. Bitcoin is still in its early stages, and the longer you hold, the more rewards you’ll see as adoption continues to grow.

🧭 How to Get Started (Safely)

- Think long-term: Don’t worry about price swings. The power of Bitcoin is realized over years, not days or months.

- Learn first, buy second: Start by understanding the basics of wallets, security, and Bitcoin’s protocol.

- Buy small, hold long: Start with a small amount. Even $5 of Bitcoin today is an investment in the future.

Long-Term Thinking: It’s not about buying Bitcoin today and flipping it for a quick profit tomorrow. It’s about building wealth over time, hedging against inflation, and opting out of a broken financial system.

🧱 Final Thought

If you’re feeling uneasy about the future of money, you’re not alone. More and more people are waking up to the idea that Bitcoin offers a solution to the long-term devaluation of savings. It’s a way to preserve and grow your wealth, without depending on a system that’s rigged to lose value over time.

Bitcoin’s true value won’t be realized in a week, month, or even a year. But in decades? It’s positioned to be one of the most transformative financial assets the world has ever seen.

Bitcoin’s scarcity and increasing demand will likely continue to drive its price up over time, especially as more institutional investors and everyday people adopt it.

- Growing adoption: major companies and countries are now recognizing Bitcoin as a legitimate asset class.

- Digital gold comparison: why Bitcoin is superior in today’s digital, global economy.

“Bitcoin isn’t just a currency—it’s a revolution in wealth preservation.”

Credit: ChatGTP