The Root of the Problem: A Broken Monetary System

Most of the world’s economic and social problems can be traced back to one underlying issue: broken money. Inflation, wealth inequality, financial instability, and government overreach all stem from a monetary system controlled by centralized institutions that can print and manipulate currency at will. This system benefits the few at the expense of the many, distorting incentives and eroding trust.

For decades, governments and central banks have expanded the money supply, causing prices to rise while wages struggle to keep up. The result? A system where saving becomes nearly impossible, debt is encouraged, and financial crises are routine.

How Bitcoin Fixes the Money

Bitcoin presents a radically different approach: a decentralized, fixed-supply monetary system that no single entity can control. Here’s why Bitcoin is a better form of money:

✅ Fixed Supply – Unlike fiat currencies that can be inflated endlessly, Bitcoin has a hard cap of 21 million coins. This scarcity protects against devaluation.

✅ Decentralized & Censorship-Resistant – No government or central bank can manipulate Bitcoin’s monetary policy. Transactions are secure, transparent, and resistant to political interference.

✅ Financial Freedom – Bitcoin allows individuals to be their own bank, removing reliance on traditional financial institutions that can restrict access to money.

✅ Long-Term Stability – Over time, Bitcoin’s predictable issuance schedule and resistance to inflation make it a better store of value compared to fiat currencies, which continually lose purchasing power.

Fix the World: The Impact of Sound Money

When money is sound, economies and societies thrive. Bitcoin’s principles align with a more just and sustainable financial system:

🔹 Lower Wealth Inequality – In a Bitcoin standard, money is earned through value creation, not government favoritism or inflationary policies that disproportionately benefit asset holders.

🔹 Reduced Corruption & Cronyism – Governments and corporations lose the ability to manipulate money for their own benefit, leading to a fairer economic system.

🔹 Stronger Individual Sovereignty – People regain control over their wealth, reducing dependence on unstable banks or authoritarian financial restrictions.

🔹 A Global Monetary System for Everyone – Bitcoin is accessible to anyone with an internet connection, providing financial services to the unbanked and underbanked across the world.

Join the Movement

The transition to a Bitcoin-based economy won’t happen overnight, but every step toward adopting sound money is a step toward fixing the world. Here’s how you can get started:

1️⃣ Learn About Bitcoin – Educate yourself on why Bitcoin matters and how it works.

2️⃣ Start Using Bitcoin – Get a wallet, secure your keys, and make your first transaction.

3️⃣ Opt Out of Fiat Dependency – Convert savings into Bitcoin and support businesses that accept it.

4️⃣ Spread the Word – Share knowledge and help others understand why fixing the money is the key to fixing the world.

🚀 The future is decentralized. The future is Bitcoin. (Credit: ChatGTP)

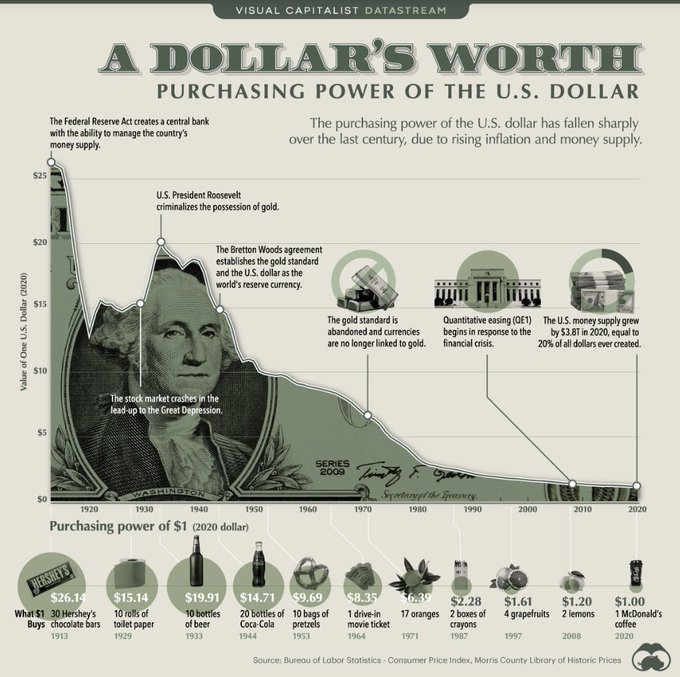

Image: A Dollar’s Worth. The decline of the purchasing power of the US Dollar.

The image illustrates the decline in the purchasing power of the U.S. dollar over the past century, portraying inflation as a continuous erosion of value. This concept directly connects with the Bitcoin trope “Fix the money, fix the world,” which suggests that the degradation of fiat currencies due to inflationary monetary policies has widespread consequences on society and the economy.

Bitcoin enthusiasts argue that the root cause of many societal issues lies in centralized monetary systems. For example, the U.S. dollar has been affected by decisions like the abandonment of the gold standard, quantitative easing, and substantial increases in the money supply during financial crises. These measures, while sometimes aimed at stabilizing the economy, have contributed to the declining purchasing power depicted in the image.

Bitcoin, with its fixed supply capped at 21 million coins, offers an alternative monetary system resistant to inflation. Advocates believe that adopting Bitcoin could prevent the wealth erosion caused by currency devaluation. The trope “Fix the money, fix the world” implies that by solving issues related to the monetary system—such as unchecked money printing and inflation—broader societal problems can also be addressed. The idea is that a sound monetary foundation leads to economic stability, reduced inequality, and a healthier global economy.

This image reinforces the narrative by vividly demonstrating how far the value of fiat money has fallen. For Bitcoin supporters, it underscores the urgency to transition to a system where money maintains its worth and integrity over time, thereby fostering a world that thrives economically and socially. (Credit: Copilot)

Sound Money

The movie Margin Call features a scene where the character John Tuld, played by Jeremy Irons, recites numerous dates in one impactful monologue. He uses them to highlight the cyclical nature of financial crises, emphasizing that such events are recurring and inevitable2. It’s a powerful moment that underscores the fragility of the monetary system and the patterns of human behavior in finance:

1637: The Dutch Tulip Mania burst, marking one of the first recorded speculative bubbles. Though it didn’t collapse the broader economy, it highlighted the dangers of speculative trading.

1797: The Panic of 1797 was triggered by land speculation and the suspension of specie payments by the Bank of England, leading to deflation and economic distress.

1819: The Panic of 1819 was the first major financial crisis in the U.S., caused by land speculation, unregulated banking, and a contraction of credit by the Second Bank of the United States.

1837: The Panic of 1837 followed speculative lending, a collapsing land bubble, and Andrew Jackson’s Specie Circular, which required land payments in gold or silver, leading to a prolonged depression.

1857: The Panic of 1857 was a global financial crisis caused by declining international trade, over-expansion of the U.S. economy, and the failure of major banks.

1884: The Panic of 1884 was a banking crisis in New York, triggered by the failure of key financial institutions and a credit shortage.

1901: A stock market panic occurred due to speculative trading and attempts to corner the market on Northern Pacific Railway stock.

1907: The Panic of 1907, also known as the Knickerbocker Crisis, was a banking panic caused by failed speculation and a lack of liquidity, leading to the creation of the Federal Reserve System.

1929: The Stock Market Crash of 1929 marked the start of the Great Depression, driven by speculative investments, margin trading, and a lack of regulatory oversight.

1937: The Recession of 1937–38 occurred during the Great Depression recovery, caused by contractionary fiscal and monetary policies.

1974: The collapse of the Bretton Woods system and the oil crisis led to stagflation, combining high inflation with economic stagnation.

1987: The Black Monday stock market crash was caused by program trading and market overvaluation, leading to a 22% drop in the Dow Jones in a single day.

1992: Black Wednesday saw the British pound forced out of the European Exchange Rate Mechanism due to speculative attacks, leading to its devaluation.

1997: The Asian Financial Crisis began with the collapse of the Thai baht, spreading to other Asian economies due to speculative attacks and unsustainable debt levels.

2000: The Dot-com Bubble burst, driven by speculative investments in internet companies, leading to a significant market downturn.

2008: [The movies setting]

This ties into the Bitcoin trope “Fix the money, fix the world” by providing historical evidence of the failures inherent in centralized monetary systems. In Margin Call, John Tuld’s recitation of dates showcases the repetitive nature of financial crises caused by human greed, speculative excess, and flawed systemic foundations. These crises reveal the fragility of fiat currencies and centralized banking, which Bitcoin enthusiasts argue are the root causes of global economic instability.

The Bitcoin trope suggests that by transitioning to a decentralized monetary system like Bitcoin, which operates on transparent principles and a fixed supply, society could eliminate many of the issues tied to fiat money. Bitcoin offers an alternative that resists inflation and speculative manipulation, aiming to stabilize the global economy and reduce inequality.

The cyclical pattern highlighted in the movie reflects the need for a fundamental shift—precisely what Bitcoin advocates call for when they argue, “Fix the money, fix the world.” It suggests that solving monetary flaws could lead to a cascade of improvements in governance, economic opportunity, and societal well-being.

The “sound money” argument is deeply ingrained in Bitcoin’s ideology. Proponents believe that Bitcoin’s predictable and limited supply creates a more stable and reliable form of money. They argue that this stability will lead to greater economic prosperity and individual freedom. (Credit: CoPilot and Gemini)

Video: Fix the Money, Fix the World with Lawrence Lepard

Lawrence Lepard joins for a conversation about Bitcoin and gold as a check against inflation, US Debt to GDP, why Keynesian economics is flawed, how dishonest money corrupts society, Bitcoin as a transformative technology, and how fixing the money, fixes the world. Lawrence Lepard is the founder of Equity Management Associates, an investment firm focused on growing private and public companies around the world.

Timestamps:

0:00 – WiM Show Intro

3:09 – Helping Lightning Startups with In Wolf’s Clothing

3:56 – Introducing Larry Leopard

9:52 – Becoming a Gold Bug

14:29 – Gold Bug to Bitcoin

25:03 – Checks Against Money Printing

32:16 – Inflation 101

39:29 – US Debt to GDP

42:09 – The Problem with Keynesian Economics

55:34 – Do Keynesians Believe their Bullshit?

01:01:26 – How Dishonest Money Destabilizes Society

01:09:16 – Heart and Soil Supplements

01:10:16 – Anthony DiClementi’s Biohacking Secrets

01:11:46 – What are US Treasury Bonds?

01:23:30 – How the US Pays Back It’s Debt

01:36:07 – Timeline of Monetary Debasement

01:41:51 – How Technology Shapes Our Perception of the World

01:49:42 – Costco and Gold Sales

01:54:01 – GameStop and “Dumb Money”

01:56:48 – Swan Bitcoin: Set up instant and Recurring Bitcoin Buys

01:57:44 – Bitcoin 2024: The Largest Bitcoin and Fintech Conference in the World

01:59:06 – Executive Order 6102 and Bitcoin

02:10:24 – Bitcoin as a Transformative Technology

02:22:43 – How Bitcoin makes Government Local Again

02:27:05 – Fix the Money, Fix the World

02:35:24 – Money Through the Lens of Good vs Evil

02:46:09 – Closing Thoughts

[Image: ImageFx]

Leave a Reply